What umbrella insurance is and what it covers

After 10 years of saving and sacrificing you’ve just closed escrow on your first home – congratulations! Now that all the paperwork and stress from the move is over, it’s time to celebrate with a housewarming party for your family and friends. You decide outside is best, since your new backyard is complete with an impressive patio and swimming pool for entertaining. Your patio has an umbrella, but do you know what umbrella insurance is? You’ll need to know if the following happen.

During the party, your friend’s date slips on a loose brick near your swimming pool that you were unaware of. He trips, hits his head and falls into the water. His injury is serious and results in a lawsuit against you, the homeowner. The amount he is awarded for his injuries exceeds what your homeowners insurance policy covers, leaving you with a hefty balance to come up with out of pocket. Depending on the state where you live, your wages may be garnished or a lien placed on your home if you are unable to pay what is owed. Either of these collection methods can negatively impact your credit. When the unexpected occurs and your assets are at risk, that’s when umbrella insurance comes into the picture.

What Is Umbrella Insurance?

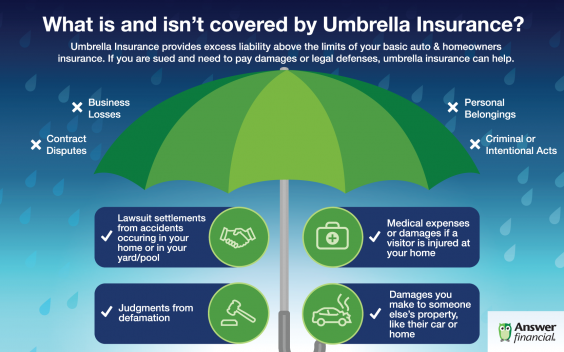

Although it is unsettling to think about life’s unforeseen events, accidents can (and do) happen. An umbrella policy can provide you with excess liability above your primary insurance limits. For example, if your homeowners policy covers you for $300,000 in liability and you were sued for $350,000, umbrella insurance could help cover the additional $50,000. Umbrella insurance is typically sold in million-dollar increments, beginning at $1 million, and can be surprisingly inexpensive for the amount of coverage it provides.1 Umbrella Insurance can provide peace of mind that your home, auto and other assets are more fully protected.

What Does Umbrella Insurance Cover That My Other Policies Do Not?

Much like the homeowner who was sued for the head injury that occurred in her backyard, you could also find yourself involved in a lawsuit one day. If you are involved in an accident, or if one happens on your property, the liability coverage from either your homeowners, auto or other insurance policy (depending on the type of accident) may kick in first If the damages exceed what your base policy covers, your umbrella coverage can help you pay the rest of what you owe. Umbrella insurance can also provide your family with:

- Personal injury coverage (defamation of character, invasion of privacy, libel, slander)

• Defense coverage for attorney fees and other legal costs

Who Is a Good Candidate for Umbrella Insurance?

Unlike homeowners, auto and other personal lines of insurance, you are not required by law to carry a policy for umbrella insurance. While it’s definitely a smart idea for any homeowner to consider purchasing an umbrella policy, it’s often essential for other groups as well. If you do not own a home, but fall into one of the categories below, you may want to consider buying additional protection as well:

- Property owners (valuable assets other than a home)

• Those with significant savings

• Travelers planning to visit or work outside the US

• Parents who coach kids’ sports teams

• Athletes who engage in sports that could injure others (hunting, skiing, etc.)

• Owners of trampolines, swimming pools and animals

Who is Answer Financial?

As one of the nation’s largest and most reputable auto & home insurance agencies, Answer Financial has insured nearly 5 million homes and vehicles. We work with more than 40+ top-rated carriers to save our customers an average of $565 a year on insurance.*

On our mobile-friendly website, shoppers can quickly compare rates and customize coverages from multiple home insurers. By simply entering your zip code and home address, Answer can search publicly available records like square footage and year built to deliver side-by-side comparison quotes from reputable insurance companies.

Answer Financial can help you compare, buy and often save the smart way on insurance. So before you shop, remember to rely on your insurance experts to find you the right home insurance plan for your needs and budget.

*Results of a national survey of new Answer Financial customers reporting insurance savings 2023.

September 5, 2023